Using Credit Card Internationally Guide – Embarking on international adventures? Understanding how to navigate using credit card internationally is crucial for a seamless experience. From securing transactions to maximizing rewards, this guide dives into essential tips and tricks. Whether you’re dining in Paris or shopping in Tokyo, learn how to make your credit card your best travel companion, ensuring safety, convenience, and financial savvy on your global journeys.

Introduction to International Travel with Credit Cards

Embarking on a journey abroad is thrilling. Yet, it demands smart financial planning. Credit cards offer a convenient way to manage expenses. They’re safer than carrying cash and provide a record of your spending. Before you jet off, understanding the ins and outs of your card is key. This ensures a smooth, hassle-free adventure. So, let’s dive into the essentials of using credit cards for international travel.

Navigating foreign lands with your credit card can be a breeze. However, it’s vital to be aware of potential fees. Banks often charge for transactions in foreign currencies. Moreover, using credit card internationally might incur additional costs. To avoid surprises, check with your bank beforehand. They can offer valuable advice on minimizing fees. Plus, they’ll inform you about any travel benefits your card offers, enhancing your travel experience.

Lastly, security is paramount when traveling. Credit cards provide robust fraud protection. Yet, notifying your bank of your travel plans is crucial. This prevents your card from being flagged for suspicious activity. Additionally, explore cards with no foreign transaction fees. Such cards can save you money, making every transaction smoother. With these tips, your credit card becomes a powerful tool, ensuring peace of mind on your international adventures.

Understanding Credit Card Fees Abroad

When you’re exploring new countries, credit card fees can catch you off guard. Many travelers don’t realize the costs associated with international transactions. Banks often charge a fee for each purchase made in a foreign currency. These fees can add up, affecting your travel budget. It’s essential to understand these charges to manage your finances effectively while abroad. Knowledge is power, especially when it comes to financial matters on international trips.

Moreover, some credit cards are designed with the global traveler in mind. These cards may offer lower fees on foreign transactions, or even waive them entirely. Researching and choosing a card that fits your international travel needs can save you a significant amount of money. Additionally, some cards offer rewards or cash back on purchases made abroad, further offsetting any fees. Transitioning to such a card could be a wise financial move before your next journey.

Lastly, it’s not just about the fees. The exchange rates applied to your transactions also matter. Banks use different rates, which can impact the final cost of your purchases. Always opt for transactions in the local currency to avoid additional charges from dynamic currency conversion. By being informed and prepared, you can use your credit card internationally without unnecessary expenses. This approach ensures a more enjoyable and cost-effective travel experience.

Navigating Currency Conversion Like a Pro

Currency conversion is a critical aspect of using your credit card internationally. When abroad, you’ll encounter prices in local currencies, requiring conversion to your home currency for billing. This process can introduce conversion fees, which vary by card issuer. Understanding these fees and how they’re calculated is essential. It empowers you to make informed decisions, ensuring you get the best possible deal on every transaction.

Interestingly, some credit cards offer the perk of no currency conversion fees. This feature can be a game-changer for frequent travelers. By selecting a card that waives these fees, you can save a considerable amount over time. Additionally, these cards often provide competitive exchange rates. This means you’re not just avoiding extra charges but also getting more value for every dollar spent. It’s a win-win situation that enhances your travel budget significantly.

Furthermore, always opt for local currency payments when using your credit card internationally. Merchants may offer to charge you in your home currency, a practice known as dynamic currency conversion. While it seems convenient, it often comes with poor exchange rates and additional fees. Insisting on local currency charges ensures you benefit from your card issuer’s more favorable rates. This simple choice can lead to substantial savings, making your international spending more efficient.

Ensuring Secure Transactions on Your Journey

Security is paramount when using your credit card internationally. The excitement of exploring new destinations shouldn’t distract from the importance of financial safety. Fraudulent activities can occur anywhere, but certain precautions can significantly reduce risks. Always keep your card in sight during transactions and use ATMs in secure locations. Awareness and caution are your best defenses against unauthorized access to your funds.

Moreover, technology offers additional layers of protection. Many credit cards now feature chip technology and require a PIN for transactions, enhancing security. Before traveling, ensure your card has these features and understand how to use them. Also, set up alerts for foreign transactions. This way, you’ll be immediately informed of any suspicious activity. Quick detection is crucial for minimizing potential damage and resolving issues promptly.

Lastly, always have a backup plan. Carry an alternative form of payment, such as another credit card or a prepaid travel card. Diversifying your payment options ensures you’re not left stranded in case of a lost or blocked card. Additionally, inform your bank of your travel plans. This prevents your card from being mistakenly frozen for suspected fraud. Taking these steps guarantees peace of mind, allowing you to focus on enjoying your international adventures.

Maximizing Credit Card Benefits While Traveling

Traveling internationally opens up a world of opportunities to leverage credit card benefits. Many cards offer rewards like points, miles, or cash back on purchases. These perks can be particularly lucrative when applied to travel expenses such as flights, hotels, and car rentals. By choosing a card tailored to your travel habits, you can significantly reduce the cost of your trips. It’s all about selecting the right card and using it wisely.

Additionally, some credit cards come with invaluable travel insurance. This coverage can include trip cancellation, lost luggage, and medical emergencies. Before embarking on your journey, review your card’s benefits package. Understanding the extent of your coverage is crucial. In the event of an unexpected hiccup, knowing you have financial protection can offer immense peace of mind. It’s one of the many ways your credit card can be a powerful ally abroad.

Furthermore, exclusive access to airport lounges is another perk worth mentioning. Waiting for flights can be a more pleasant experience with complimentary refreshments, Wi-Fi, and comfortable seating. This benefit, available through certain credit cards, transforms airport waits into enjoyable pauses. Always check if your card offers lounge access and plan your airport visits accordingly. It’s a simple yet effective way to enhance your travel experience, making every journey more enjoyable.

Protecting Yourself Against Fraud Overseas

Traveling internationally opens up a world of experiences, but it also exposes you to the risk of credit card fraud. Vigilance is key. Always monitor your account statements and transaction alerts. This habit helps you spot any unauthorized charges quickly. Early detection is crucial for resolving fraud issues promptly, ensuring minimal impact on your travel plans and finances.

Furthermore, embracing technology enhances your defense against fraud. Many banks offer mobile apps that allow you to lock and unlock your credit card. If you suspect your card has been compromised, you can immediately secure it with a tap. Additionally, using secure Wi-Fi connections for any financial transactions is essential. Public Wi-Fi networks can be vulnerable to hackers. Therefore, consider using a VPN for an added layer of security when accessing your financial information.

Lastly, being prepared for the worst-case scenario is wise. Keep a record of your credit card information and the customer service phone number separate from your card. In the event of loss or theft, this enables you to act swiftly. Contacting your bank immediately to report the issue is imperative. They can freeze your account, preventing further unauthorized use. Taking these proactive steps ensures you’re well-protected against fraud while using your credit card internationally.

Withdrawing Cash Internationally: Tips and Tricks

Withdrawing cash while exploring foreign lands is often necessary, despite the convenience of using credit cards. Understanding the nuances can save you from incurring high fees. Always opt for ATMs affiliated with reputable banks. They tend to offer better exchange rates and lower withdrawal fees. This strategy keeps more money in your pocket, allowing you to enjoy your travels without worrying about unnecessary expenses.

Moreover, when using your credit card internationally for cash withdrawals, be mindful of the charges. Cash advance fees and interest rates can be significantly higher than those for purchases. To mitigate these costs, consider using a debit card for cash withdrawals instead. This approach can offer a more cost-effective way to access local currency. Remember, planning your cash needs in advance can help avoid the stress of finding a compatible ATM in a pinch.

Lastly, always inform your bank of your travel plans before departing. This step is crucial to ensure your card remains active while you’re abroad. Banks may flag foreign transactions as suspicious and block your card to prevent fraud. A quick call can prevent this inconvenience, ensuring you have access to your funds when you need them. By following these tips, withdrawing cash internationally becomes a hassle-free part of your travel experience.

Earning and Using Travel Rewards Effectively

Travel rewards cards are a boon for international travelers, offering a way to earn points on every purchase. These points can be redeemed for flights, hotel stays, and even experiences, making your travels more affordable and enjoyable. To maximize these benefits, choose a card that aligns with your travel habits and preferences. This strategic selection ensures you’re earning rewards on the spending you’re already doing.

Additionally, understanding the best times to redeem your rewards can enhance their value. Some programs offer bonuses or higher redemption rates for certain types of bookings. Keeping an eye on these opportunities allows you to get the most out of your points. Furthermore, consider cards that offer no blackout dates or restrictions. This flexibility is invaluable for planning trips around your schedule, not the limitations of your rewards program.

Lastly, when using your credit card internationally, look for opportunities to earn extra points. Many cards offer additional rewards for spending in foreign currencies or on travel-related purchases. This feature can accelerate your rewards accumulation, bringing you closer to your next free trip. Always review the rewards structure of your card before traveling. This ensures you’re aware of any categories or promotions that could benefit your travel budget.

Where is Your Credit Card Accepted Globally?

Understanding where your credit card is accepted globally is crucial for hassle-free international travel. Major credit card networks like Visa and Mastercard boast widespread acceptance around the world. However, certain regions or merchants may prefer one network over another. Before you travel, research the preferred payment methods in your destination. This preparation ensures you’re never caught off guard when it’s time to pay.

Moreover, while planning for international use, consider the presence of contactless payment options. Many countries have embraced this technology for its convenience and security. If your credit card supports contactless payments, you might find transactions smoother and faster abroad. Additionally, this method often requires no currency conversion on your part, as the terminal handles it. Embracing such modern payment methods can enhance your travel experience significantly.

Lastly, it’s wise to have a backup payment method. Not all places accept credit cards, especially in remote or less developed areas. Having access to local currency or a secondary card from a different network can save the day. This approach ensures that, regardless of where you are, you’ll be able to cover expenses without hassle. By preparing for various payment scenarios, you ensure a smooth financial experience while using your credit card internationally.

Financial Planning for Your International Trip

Financial planning is the cornerstone of a stress-free international trip. Budgeting for your journey requires a careful balance between saving and spending. Start by estimating your major expenses, such as flights and accommodations. Then, allocate funds for daily activities, dining, and unexpected costs. This comprehensive approach ensures you enjoy your travels without financial worries, allowing you to immerse fully in the experience.

Moreover, part of this planning involves considering how you’ll use your credit card internationally. It’s not just about the convenience; it’s also about leveraging your card’s benefits. Travel insurance, no foreign transaction fees, and reward points can significantly enhance your travel budget. Review your card’s features and plan your spending to maximize these benefits. This strategy not only saves money but also adds value to every transaction you make abroad.

Lastly, always prepare for emergencies. Despite the best planning, unexpected expenses can arise. Having a contingency fund accessible via your credit card can provide peace of mind. Additionally, familiarize yourself with your card’s emergency services, such as replacement for lost or stolen cards. Knowing you have a financial safety net allows you to explore new horizons with confidence, making every moment of your international adventure memorable.

Conclusion

Traveling internationally with a credit card offers unparalleled convenience and security, transforming your global adventures into seamless experiences. By understanding the nuances of international fees, currency conversion, and the benefits of your card, you can navigate foreign lands with ease. The key is preparation and knowledge, ensuring that your travels are not just about exploring new destinations but also about smart financial management.

Moreover, the importance of using your credit card internationally extends beyond mere transactions. It encompasses earning valuable rewards, enjoying enhanced security, and accessing a world of financial flexibility. Embracing these advantages allows you to immerse fully in the joy of travel, knowing that your financial needs are efficiently managed. Always remember to choose a card that aligns with your travel habits and destinations for the best experience.

Lastly, the journey of international travel with a credit card is one of discovery and learning. Each trip offers insights into managing finances in diverse landscapes, ensuring that with each adventure, you become a more savvy and prepared traveler. So, pack your bags and your credit card, and set off on your next journey with confidence and excitement, ready to explore the world while smartly managing your finances.

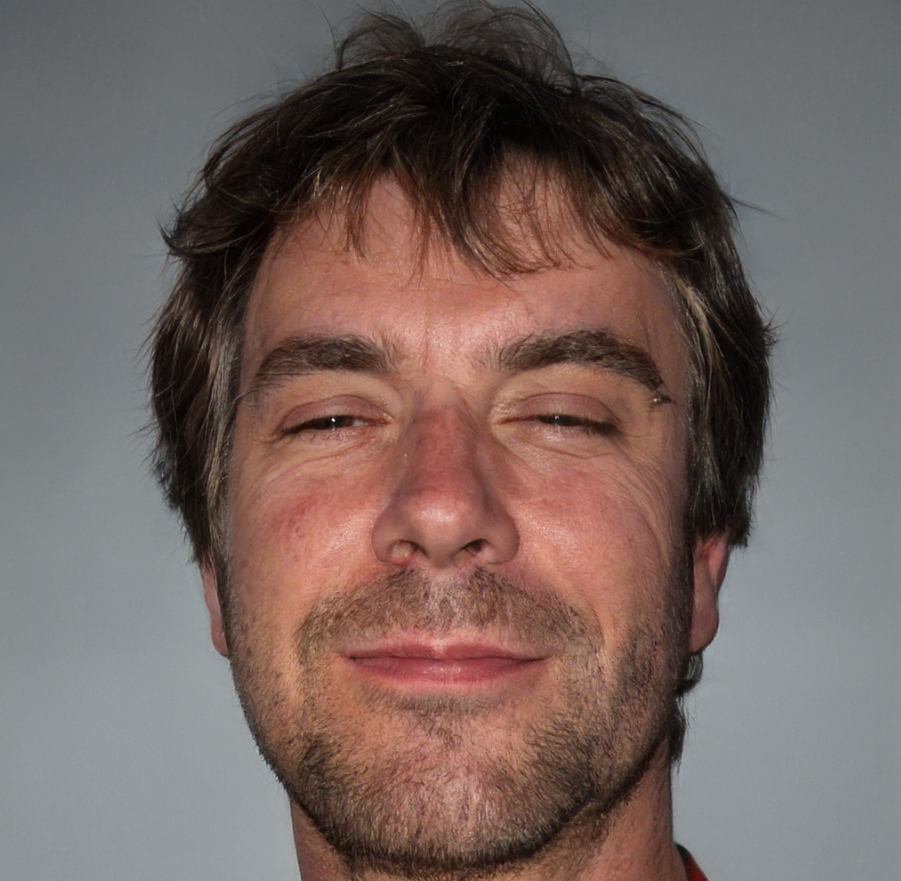

Ryan Taylor, a seasoned traveler with over a decade of experience exploring Europe’s nooks and crannies, offers a wealth of knowledge and unique insights into the continent’s diverse cultures and landscapes. His passion for travel began in his early twenties, and since then, Ryan has journeyed through numerous European countries, collecting stories, tips, and a deep understanding of each destination’s unique charm. His blog entries are not just guides but narratives enriched with personal experiences, making every recommendation and piece of advice relatable and practical for fellow travel enthusiasts. With a keen eye for hidden gems and a love for sharing his adventures, Ryan’s writings are a treasure trove for anyone seeking to discover the beauty and richness of Europe.